At its core, calculating your customer acquisition cost is straightforward. You just divide your total sales and marketing spend over a certain period by the number of new customers you brought in during that same timeframe. But this one number tells you so much—it’s the exact price tag on winning each new customer, making it a vital health check for your business.

Why Mastering CAC Calculation Is Your Growth Superpower

Let’s be honest—tracking Customer Acquisition Cost (CAC) can feel like a chore, something you pass off to the finance team. But what if it's actually the most powerful tool you have for building sustainable growth? In this market, flying blind on what it costs to get a customer isn't just risky. It’s a surefire way to burn through cash and miss out on real opportunities.

Knowing this single metric is the difference between guessing and knowing. It sharpens nearly every strategic decision you'll make, from setting your marketing budget to figuring out your pricing.

The True Cost of Winning Customers

Getting a new customer isn't getting any cheaper. In fact, it's become wildly more expensive to earn someone's attention. Over the last ten years, the global average Customer Acquisition Cost has jumped by a staggering 222%. This spike is mostly because of soaring ad prices and everyone competing for the same eyeballs. A decade ago, businesses might have lost around $9 for each new customer; today, that loss has shot up to $29. This paints a clear picture of the growing struggle to acquire customers efficiently. You can read more about these rising acquisition trends and what they mean for your strategy.

This tough reality makes a precise customer acquisition cost calculation more critical than ever. It's not just a "nice-to-have" metric anymore; it's an absolute must for a smart business strategy.

What Goes Into an Accurate CAC

To get a real handle on your CAC, you have to count every single dollar that goes into your customer acquisition efforts. This means looking way beyond just what you spend on ads. A truly accurate calculation pulls in all the direct and indirect costs that keep your sales and marketing teams running.

To make sure you're not missing anything, let's break down the essential costs you need to include.

Core Components of Customer Acquisition Cost

Here’s a quick summary of the key cost categories that must be included for an accurate CAC calculation.

| Cost Category | Description & Examples |

|---|---|

| Advertising Spend | This is the direct cost of any paid campaigns. Think: Google Ads, Facebook Ads, LinkedIn campaigns, and fees for influencer marketing. |

| Team Salaries | You need to include compensation for everyone on your sales and marketing teams. This covers salaries, commissions, and bonuses for your marketing managers, sales reps, and content creators. |

| Software & Tools | These are the costs for the tech that powers your acquisition engine. Your CRM software (like CustomerCloud), marketing automation tools, and analytics platforms all count. |

| Creative & Content | Don't forget the expenses for producing your marketing materials. This includes paying freelance writers, graphic designers, or video production agencies. |

| Overhead | A portion of your general business expenses should be allocated here. This could be part of the rent for the office space your marketing team uses or a share of the utility bills. |

Key Takeaway: The single biggest mistake I see people make is forgetting to include salaries and software costs. These are often the largest chunk of your acquisition spending, and leaving them out will give you a dangerously rosy (and completely wrong) number.

Ultimately, getting your customer acquisition cost calculation right gives you the clarity to build a profitable business that can actually scale. It turns your marketing from a cost center into a predictable engine for growth.

The Fundamental Customer Acquisition Cost Formula

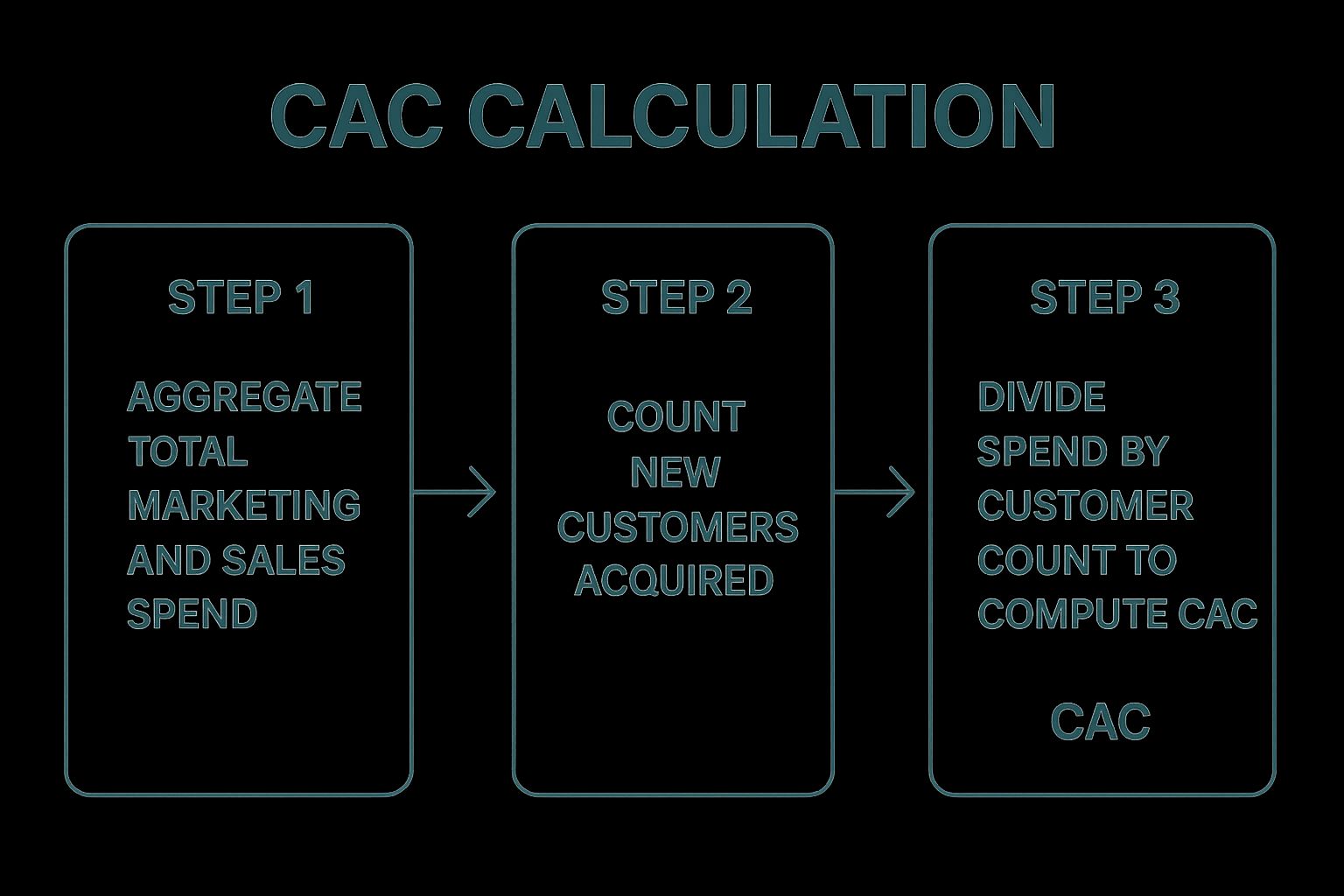

On the surface, the formula for customer acquisition cost looks straightforward. Just divide your total sales and marketing spend by the number of new customers you brought in over a set time. Simple, right? But the real value of your customer acquisition cost calculation comes down to what you actually decide to include in those two buckets.

The devil is always in the details here. If you take a vague or incomplete approach, you'll end up with a number that looks good but is ultimately misleading. That can lead straight to bad budget decisions and growth targets that are pure fantasy. Let's walk through how to do it properly.

This process isn't just about plugging numbers into a formula. It's about a disciplined approach to gathering your data first.

As you can see, getting an accurate CAC is a multi-step journey. It starts with a thorough accounting of your costs before you even think about opening a calculator.

Defining Your Total Costs

The single biggest mistake I see businesses make is only counting their direct ad spend. To get a true, honest-to-goodness CAC, you have to account for every single dollar that goes into your acquisition machine. This means looking well beyond just the campaign budgets.

A truly complete cost inventory should include:

- Salaries and Commissions: This is a huge one. You need to factor in the salaries of your entire marketing and sales teams, plus any sales commissions or performance bonuses paid out during that period.

- Software and Tools: The monthly or annual fees for your tech stack are a direct cost of doing business. This includes your CRM like CustomerCloud, any marketing automation software, and your analytics tools.

- Creative and Content Production: Did you pay a freelance writer for a series of blog posts? What about that designer you hired for new ad creative? Those costs absolutely belong in your calculation.

- Overhead Allocation: Think about it—your sales and marketing teams take up office space. A portion of that rent and those utilities should be attributed to your acquisition costs. It's a real expense supporting the effort.

Nailing Down Your Customer Count

The other side of the equation—counting your new customers—can be trickier than you'd think. It is absolutely critical to have a firm, consistent definition of what a "new customer" means for your business.

Are you only counting brand-new logos, or are you including former customers who came back after a year-long absence? Whatever you decide, you have to stick with it. If your definition changes from quarter to quarter, you won't be able to spot actual trends. Consistency is everything.

My Personal Tip: When I first started tracking CAC, I made the classic blunder of forgetting to include software costs. My number looked fantastic, but it was a lie. Once I added in our CRM, automation platform, and analytics subscriptions, our true CAC jumped by nearly 40%. It was a real wake-up call that forced us to get much smarter about where our money was going.

A Real-World CAC Calculation Example

Let's make this concrete. Imagine a SaaS startup wants to figure out its CAC for the first quarter of the year.

First, they have to round up all their relevant costs from January, February, and March:

- Ad Spend: $25,000 (across all their Google and social media campaigns)

- Team Salaries: $150,000 (for their marketing and sales staff)

- Software Subscriptions: $1,000 (for their CRM and other marketing tools)

This gives them a Total Sales & Marketing Cost of $176,000.

Next, they log into their CRM and see that they acquired 3,000 new paying customers during that same three-month period.

Now, it’s just a matter of simple division:

($25,000 + $150,000 + $1,000) / 3,000 New Customers = $58.67 CAC

In this scenario, it cost the company $58.67 to acquire each new customer in Q1. This isn't just a guess; it's a solid, all-inclusive metric they can now use as a baseline to improve upon in the next quarter.

How to Reliably Gather Your CAC Data

Your customer acquisition cost calculation is only as good as the data you feed it. Garbage in, garbage out. If your numbers are off, you'll end up making strategic decisions based on a flawed metric, which is a surefire way to waste your budget. This isn't just about grabbing a few figures; it's about creating a data collection process you can trust.

To get a true CAC, you need to systematically pull numbers from three key parts of your business: your ad platforms, your accounting software, and your CRM.

Hunting Down Your Marketing and Ad Spend

First, let's nail down your total marketing and sales costs. This figure is often spread out across different places, so you have to be a bit of a detective. The most obvious place to start is with your digital ad platforms.

Head over to your Google Ads or Facebook Ads Manager accounts. Both have reporting dashboards where you can easily export your total ad spend for a specific period. This is your direct campaign cost.

But don't stop there. The real cost of acquisition runs much deeper. You absolutely must include these expenses:

- Software Subscriptions: Think about all the tools that help you acquire customers. This includes your CRM like CustomerCloud, your email marketing platform, SEO tools, and any analytics software you pay for.

- Content and Creative Costs: Did you pay a freelance writer for a series of blog posts? Or hire a designer to create new ad visuals? Those are direct acquisition expenses and have to be part of the total.

- External Agency or Contractor Fees: If you're working with a marketing agency or a paid media specialist, their monthly retainers or project fees are a huge part of your spend.

A Pro Tip on Data Alignment: I've seen this trip up so many businesses: mismatched date ranges. If you pull marketing costs for Q1 (January 1 – March 31), you have to use that exact same period when you count your new customers. Being off by even a single day can completely skew your CAC and hide what’s really happening.

Locating Sales and Team Costs

Forgetting to include salaries is easily the biggest mistake I see companies make in their customer acquisition cost calculation. Your team is your most powerful asset, and often your most expensive one. The best place to find this data is in your accounting software.

Fire up a program like QuickBooks or Xero and run a payroll report for your chosen time frame. Make sure you're pulling the gross salaries, commissions, and any performance bonuses for everyone on your marketing and sales teams. This gives you the complete cost of the people driving your growth.

Counting Your New Customers Accurately

The final number you need is the total count of new customers you brought in during that same period. This figure should always come from your single source of truth for customer data: your CRM.

Your CRM, whether it's a giant like Salesforce, HubSpot, or a focused tool like CustomerCloud, is built to track a customer's journey from a curious lead into a paying client. This is where you'll filter for new customers whose "close date" or "conversion date" falls squarely within your timeframe.

This is where a good, clean dashboard is worth its weight in gold. A visual report makes it simple to see how many new customers you've actually acquired.

This kind of dashboard helps you monitor new deals won and track progress against goals. More importantly, it helps ensure you’re only counting net-new customers, not accidentally including repeat buyers who would make your CAC look artificially low.

Bringing it all together takes discipline. By consistently pulling ad spend from marketing platforms, team costs from accounting, and new customer counts from your CRM, you build a reliable system. This foundation ensures your customer acquisition cost calculation is a strategic metric you can actually rely on, not just a number you guessed at.

Advanced CAC Methods for Granular Insights

A single, company-wide CAC is a great starting point, but the real power comes from digging deeper. Moving beyond a blended average shows you what's actually driving your growth and what's just draining your budget. Advanced customer acquisition cost calculation methods are how you uncover these hidden opportunities.

This isn't about making things more complicated just for the sake of it. It’s about getting the clarity you need to make smarter, more profitable decisions.

Differentiating Blended CAC from Paid CAC

So many businesses I've worked with unknowingly rely on what's called a Blended CAC. It's the high-level number we've talked about, where you lump all your marketing and sales costs together and divide by all your new customers. It's a useful health metric, but it has one major blind spot.

A Blended CAC mixes customers acquired through paid channels (like Google Ads) with those who found you organically through SEO or word-of-mouth. This can seriously mask the true performance of your paid marketing because the "free" organic customers artificially lower the average cost.

To get a clearer picture, you have to calculate a Paid CAC.

- Paid CAC focuses exclusively on the customers you acquired through paid efforts.

- The calculation is similar: (Total Paid Marketing Costs) / (New Customers from Paid Channels).

- This number tells you exactly how much you're spending to "buy" a customer, giving you a direct measure of your paid campaign efficiency.

Isolating your Paid CAC is the first step toward building a truly performance-driven marketing strategy. It helps you answer a critical question: is your ad spend actually profitable?

A Real-World Scenario: Picture an e-commerce brand that spends $10,000 on ads and gets 200 customers. Their Blended CAC looks great because they also got 300 customers from organic search. But once they calculate their Paid CAC ($10,000 / 200 = $50), they might realize it's way too high for their product's price point. This reveals an urgent need to optimize their campaigns.

Calculating CAC by Marketing Channel

Ready for the next level? Breaking down your CAC by each individual marketing channel is where things get really interesting. This is how you can truly see which parts of your strategy are pulling their weight and which are dead weight. The goal is to create a detailed performance dashboard, not just a single number.

You can calculate a specific CAC for any channel where you can track both your spending and the customers it brings in.

Some common channel-specific CACs you'll want to track include:

- Google Ads CAC: The total spend on your Google Ads campaigns divided by the number of new customers attributed to those ads.

- Social Media CAC: Your ad spend on platforms like Facebook or LinkedIn, plus any creator or influencer fees, divided by the customers from those specific campaigns.

- Content Marketing CAC: The cost of content creation (salaries, freelancers) and promotion, divided by the new customers who converted through your content funnel.

This granular approach moves you from a vague feeling that "marketing is working" to knowing with certainty that "our SEO efforts bring in customers for $15 each, while our new influencer campaign is costing us $95 per customer." That level of detail empowers you to make sharp decisions, like reallocating budget from that expensive influencer test to double down on what you know works.

An E-commerce Brand's Channel Analysis

Let's walk through a practical example. An online store selling custom pet portraits wants to compare how efficient two key channels were last quarter: their evergreen Google Ads and a new influencer marketing push.

| Metric | Google Ads Campaign | Influencer Campaign |

|---|---|---|

| Total Channel Spend | $6,000 | $4,000 |

| New Customers Acquired | 300 | 50 |

| Channel-Specific CAC | $20 | $80 |

By performing this specific customer acquisition cost calculation, the brand immediately sees a stark difference. Their Google Ads are four times more efficient at acquiring customers than the influencer campaign.

This doesn't automatically mean the influencer campaign was a total failure—perhaps it generated a ton of brand awareness. But it provides a clear, data-backed reason to investigate why the cost was so high and whether that channel is a sustainable growth lever for them. This is the kind of insight that separates businesses that scale efficiently from those that just spend.

Common Mistakes That Inflate Your CAC

Calculating your Customer Acquisition Cost (CAC) seems straightforward enough, but I've seen countless businesses make simple mistakes that lead to dangerously misleading numbers. An inaccurate CAC isn't just a number on a dashboard; it's a broken compass pointing your entire business strategy in the wrong direction.

When you think your acquisition cost is lower than it really is, you end up pouring money into unprofitable channels, pricing your products too low to ever turn a profit, and completely misjudging the health of your company. Let’s walk through the most common pitfalls so you can avoid them.

Forgetting to Include Team Salaries

This is, without a doubt, the biggest and most costly mistake I see people make in their customer acquisition cost calculation. It’s so easy to just count direct ad spend and call it a day, but what about the people running those campaigns and closing those deals? Your sales and marketing teams are the engine of acquisition, and their salaries are the fuel.

To get this right, you have to include the gross salaries, commissions, and any performance bonuses for everyone on your sales and marketing teams for the period you're measuring. The most reliable way to do this is to pull the data straight from your payroll or accounting software.

Expert Insight: I’ve seen cases where ignoring salaries made the CAC look 50-80% lower than reality. This creates a false sense of security, making you think a failing marketing channel is a roaring success.

Ignoring Your Software and Tool Costs

In modern marketing, technology is essential. Your team depends on a whole stack of software to attract, nurture, and convert leads into customers. Those monthly and annual subscription fees are a direct cost of acquiring customers, and they add up quickly.

Take a minute to list out your entire tech stack. It probably includes things like:

- CRM: The core of your customer data, like CustomerCloud.

- Marketing Automation: Platforms for email campaigns and lead nurturing.

- Analytics Tools: Software that tracks performance and user behavior.

- SEO Software: Tools for keyword research, rank tracking, and site audits.

Add up all these subscription costs for your chosen time frame. They are a fundamental part of your acquisition machine and belong in the calculation.

Confusing New and Returning Customers

The "C" in CAC stands for customer, but the unspoken rule is that it means a new customer. The whole point of this metric is to figure out what it costs to bring someone into your world for the first time. A common error is lumping returning customers into your "new acquisitions" tally.

This mistake artificially deflates your CAC because you simply don't spend the same money or effort to win back a previous buyer. You need a rock-solid, consistent definition of what a "new customer" is. Your CRM is the perfect tool for this, as it should allow you to easily filter for only net-new customers acquired within a specific period.

This level of precision is more critical than ever. We've seen the cost to acquire mobile app and e-commerce customers jump by nearly 60% in the last five years. This spike is largely driven by privacy shifts like Apple’s iOS 14.5 update and regulations like GDPR, which have made ad tracking and optimization much harder. With average acquisition costs climbing to around $29 in some industries, you can't afford to be sloppy. For a closer look at these market pressures, you can find a deep dive into these evolving acquisition costs.

Overlooking Overhead and Creative Costs

Finally, don't let the more subtle expenses slip through the cracks. These include costs for creative production and a share of your general business overhead.

Did you hire a freelance copywriter for your blog or a graphic designer for ad creative? Those project fees are absolutely acquisition costs. Similarly, your marketing and sales teams take up space, whether it's physical office space or digital infrastructure. A portion of your office rent and utilities should be allocated to their operational cost.

I know this can be trickier to calculate, but even a conservative estimate is far better than ignoring it completely. A truly reliable customer acquisition cost calculation demands this level of detail.

Even after you’ve got a process down, a few questions always seem to surface when you start calculating your customer acquisition cost. It's totally normal. Getting straight answers to these common sticking points can save you a ton of time and keep you from getting stuck in analysis paralysis.

Think of this as your go-to guide for those "what about…" moments that pop up when you're trying to nail down this metric for your own business.

How Often Should I Calculate My CAC?

Honestly, this comes down to your sales cycle. For most businesses, especially if you're in e-commerce or SaaS, a monthly calculation is the sweet spot. It gives you enough data to see how recent campaigns are doing without making you jump at every tiny daily change.

Now, if you're in a B2B space where a deal can take six months or more to close, looking at this quarterly will probably give you a much clearer, more stable picture. The most important part isn't the interval itself, but being consistent. Pick a schedule and stick to it—that’s how you get data you can actually compare over time.

What Is a Good Customer Acquisition Cost?

Ah, the million-dollar question. The real answer? It depends. A "good" CAC is only good in relation to your Customer Lifetime Value (LTV). A number that's fantastic for a company selling high-end software would be catastrophic for a business selling low-cost subscription boxes.

The Golden Ratio: A widely accepted rule of thumb for a healthy business is an LTV to CAC ratio of at least 3:1. This simply means for every dollar you put into getting a new customer, you should be getting at least three dollars back over the course of their relationship with you.

Instead of hunting for some universal "good" CAC number, pour your energy into improving your LTV:CAC ratio. That's the real health-check for your customer acquisition strategy.

How Can I Lower My Customer Acquisition Cost?

Bringing down your CAC isn't a one-and-done task; it's a constant process of tweaking and optimizing. But if you're looking for where to start, here are some of the most effective moves you can make:

- Boost Your Conversion Rate: This is the lowest-hanging fruit, hands down. Getting more customers from the traffic you already have is the quickest path to a lower CAC. Start A/B testing your landing pages, make your checkout process ridiculously simple, and be crystal clear about what you offer.

- Focus on Customer Retention: You've heard it before, but it's true: keeping a customer is way cheaper than finding a new one. When you reduce churn, your LTV goes up, which gives you more wiggle room on what you can spend to acquire new customers.

- Double Down on Your Best Channels: Do a customer acquisition cost calculation for each marketing channel. Where are your best customers coming from? Find your winners and shift your budget from the channels that are just so-so to the ones that are crushing it.

- Embrace Organic Growth: SEO and content marketing are a long game, for sure. But the customers you get from them often come at a much lower cost in the long run compared to paid ads.

By working on these areas bit by bit, you can methodically push your acquisition costs down and build a much more sustainable business.

Ready to get a crystal-clear view of your customer interactions and fine-tune your engagement strategy? CustomerCloud gives you the unified platform you need to track metrics, manage support, and make the kind of data-driven decisions that actually lower your CAC. See how it works at CustomerCloud.